Joint action with commercial banks can increase sector support to more than R$ 3 billion Program provides incentive for maintaining or expanding jobs Mills will be able to use sugarcane stock as collateral.

To help the ethanol sector, which is a major employer and has been suffering a sharp drop in consumption due to the Covid-19 pandemic, the BNDES board approved a credit program for working capital linked to product storage. As an incentive to preserve jobs, supported companies will not be able to reduce their permanent staff for two months. In addition, those that maintain or increase jobs in the next 12 months will have a cheaper cost.

In order to increase the resources directed to the sector, the Bank will work together with commercial banks: in each financing, these commercial banks will have to offer at least the same amount as the BNDES. The measure will give the plants breath to face the period and will reduce the risk of energy shortages at the time of economic recovery.

The sector is responsible for 1 million jobs in the interior of the country and for the generation of US$ 10 billion in exports per year. A survey carried out by IBRE/FGV in March points to the oil and biofuels market as the most affected by the crisis. Biofuels suffered from a drop in consumption of more than 30% and also from the drop in the international oil price – which made ethanol less competitive. In addition, sugar and alcohol companies are facing a low cash flow due to the beginning of the harvest period, which runs from April to December.

With an allocation of R$ 1.5 billion, the BNDES Support Program for the Sugar and Alcohol Sector will provide credit between R$ 10 million and 200 million, limited to 50% of the financing amount, and will be available to companies, cooperatives and individual entrepreneurs with gross operating revenue equal to or greater than R$ 300 million. Financing can be obtained directly from the BNDES, indirectly – via financial agents – or mixed. Joint action with commercial banks could therefore raise support for the sector to more than R$ 3 billion.

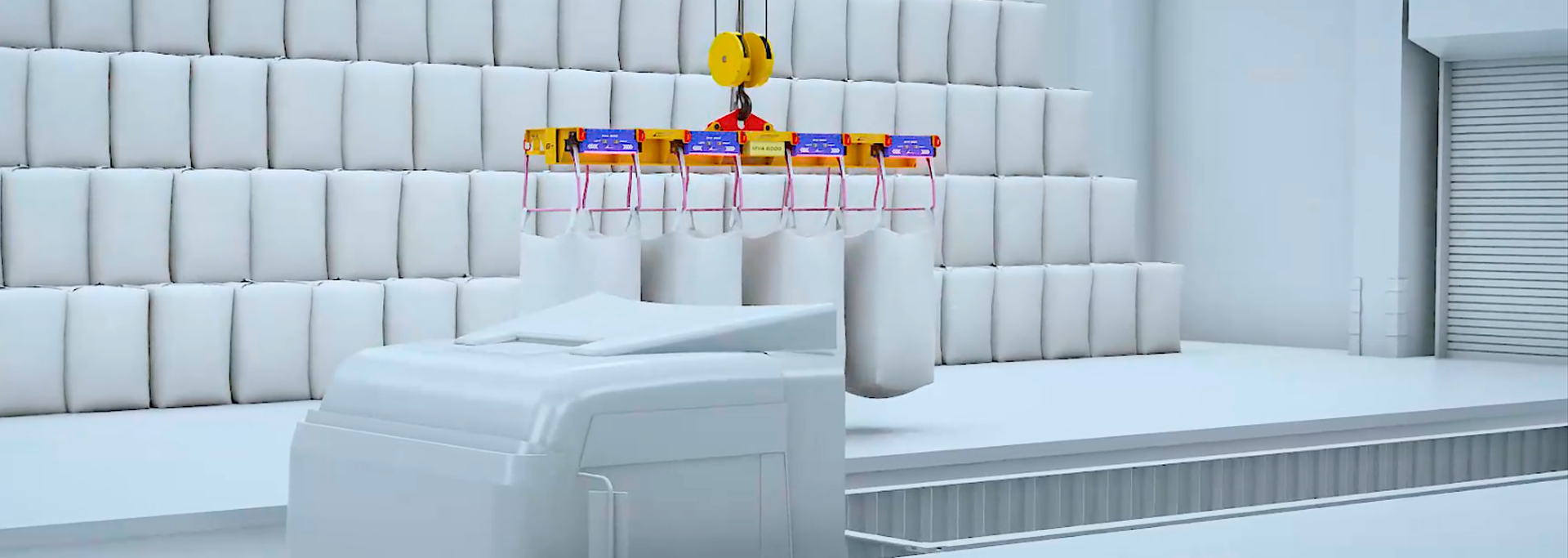

The payment period is up to two years, with a grace period of up to 12 months. The fuel stock may be presented as collateral for the loans. Applications can be filed until September 30.

Sugarcane – Sugarcane is the second largest source of the Brazilian energy matrix, with a share of 16%. In addition to supplying 70% of the national vehicle fleet – contributing to a lower dependence on the foreign oil market –, the fuel reduces carbon dioxide emissions by up to 90% compared to gasoline and diesel.

Emergency Measures – The Support Program for the Sugar and Alcohol Sector joins other recent BNDES measures to combat the economic effects of the crisis resulting from the new coronavirus pandemic, such as the emergency line for health and the expansion of working credit for Micro, Small and Medium Enterprises.

Source: BNDES via visaoagro.com.br